27+ 18 year mortgage calculator

Up to five recurring or up to ten one-time lump sum payments. Subtract your down payment to find the loan amount.

Note In Pdf 27 Examples Format Sample Examples

Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

. Assuming you have a 20 down payment 40000 your total mortgage on a 200000 home would be 160000. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. On Tuesday August 30 2022 the current average 30-year fixed-mortgage rate is 589 increasing 11 basis points since the same time last week.

January 14 At 190439 UTC the uncrewed MESSENGER space probe is at its closest approach during its first flyby of the planet Mercury. Todays national mortgage rate trends. 15-year FRMs also have rates that are lower by 025 to 1 than 30-year FRMs.

Except for a few brief sell-offs the SP 500 gained 269 for the year. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel. Yanmar VIO 50 mini digger Year 2019 Weight 4855 Hours 1435 with offset boom 2 auxiliary lines mechanical quick coupler GP bucket and Yanmar engine.

This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. The average interest rate for the most popular 30-year fixed mortgage is 55 according to data from SP Global. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. If you pay every 2 weeks thats 26 half payments. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

You will spend on principal on interest. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. January 1 Cyprus and Malta adopt the euro currency.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. By making just one extra principal payment annually you could take 5 years off a 30-year mortgage. The longest term you will be to apply for is up to your age of retirement.

2020 is expected to be a record year for mortgage originations with Fannie Mae predicting 41 trillion in originations and refinance loans contributing 27 to the total. Scotiabank Mortgage Calculator allows you to calculate your mothly mortgage payments and cash required for real estate purchases using current Scotiabank rates. But since it pays off your mortgage in half the time it incurs much lower interest charges.

The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate. 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33.

Stock markets around the world plunge amid growing fears of a US. It assumes a fixed rate mortgage rather than variable balloon or ARM. Many lenders estimate the most expensive home that a person can afford as 28 of ones income.

The Dow Jones Industrial. Or seeing the monthly mortgage payment when a. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

By the end of the mortgage term in the year 2033 by. This mortgage calculator with extra payment allows you to add extra contribution to every payment. This calculates the monthly payment of a 500k mortgage based on the amount of the loan interest rate and the loan length.

Great Recession fueled by the 2007 subprime mortgage crisis. Meanwhile there are 52 weeks in a year. Je le vend à 450.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Homeowners with 30-year mortgages will pay a lot more in interest than a 15-year mortgage since interest rates on shorter term loans are typically lower than long-term ones. Mortgage hypothec life annuity.

It was a wild year in many respects but the stock market turned in a solid performance in 2021. Getting ready to buy a home. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 718 monthly payment. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the. Mortgage amortization schedule for year 10 2031.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Second mortgage types Lump sum. 2021 2022 Mortgage Rate Housing Market Predictions Mortgage Rates.

December 27 2020 REU1386536. Do not underestimate the one extra payment a year for your mortgage because it can save. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

Thats one extra monthly payment a year. As a result by the end of the year youll pay an equivalent of 13 monthly payments. Todays mortgage rates in New York are 5603 for a 30-year fixed 5069 for a 15-year fixed and 5238 for a 5-year adjustable-rate mortgage ARM.

On the week of November 5th the average 30-year fixed-rate fell to 278. What mortgage term would you like. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Mortgage interest rates are always changing and there are a lot of factors that.

The following example compares two mortgages with the same loan amount but with different terms.

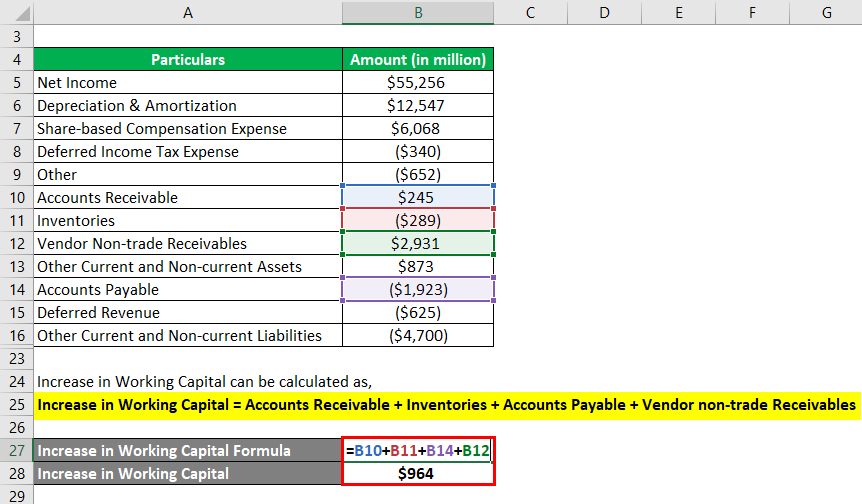

Operating Cash Flow Formula Examples With Excel Template Calculator

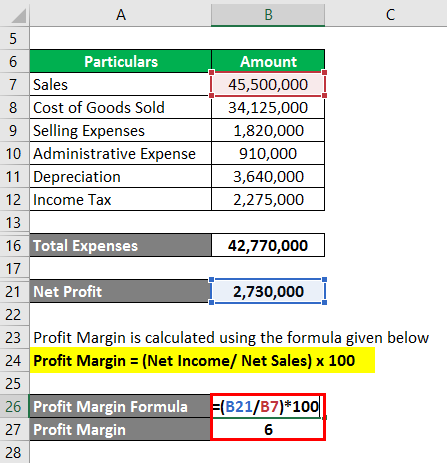

Profit Margin Formula Calculator Examples With Excel Template

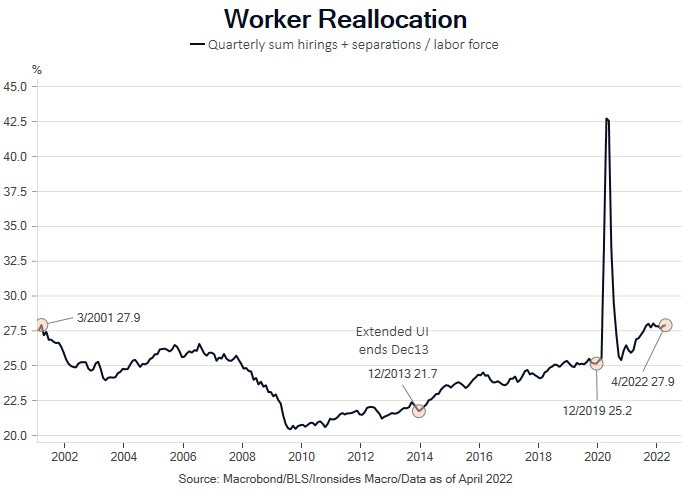

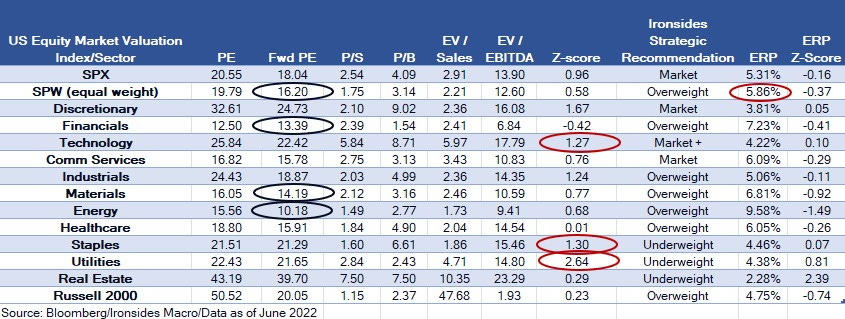

The Third Variable By Barry C Knapp

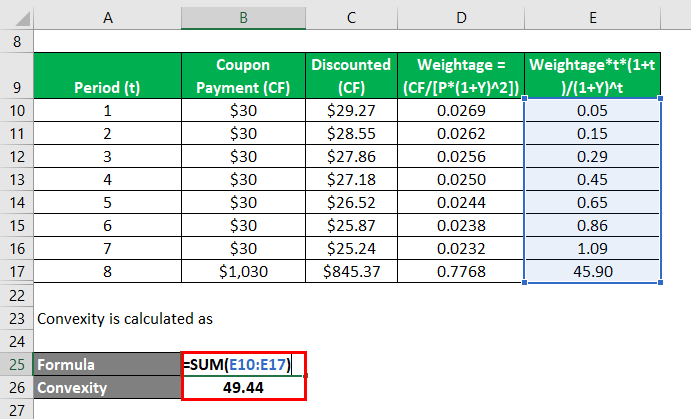

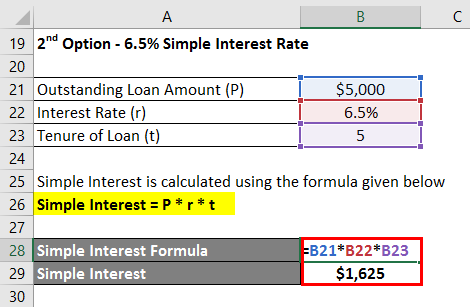

Convexity Formula Examples With Excel Template

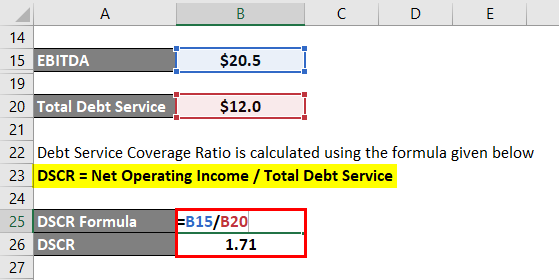

Debt Service Coverage Ratio Calculate Dscr With Practical Examples

27 Food Pantry Inventory Spreadsheet Google Docs Food Pantry Inventory Spreadsheet Natural Buff Dog Pantry Inventory Kitchen Inventory Pantry Budget

Total Debt Service Ratio Explanation And Examples With Excel Template

The Third Variable By Barry C Knapp

Adit Edtech Acquisition Corp 2021 Current Report 8 K

Free 27 Log Templates In Excel

Average Cold Call Success Rate 2022 27 Cold Calling Statistics You Need To Know Zippia

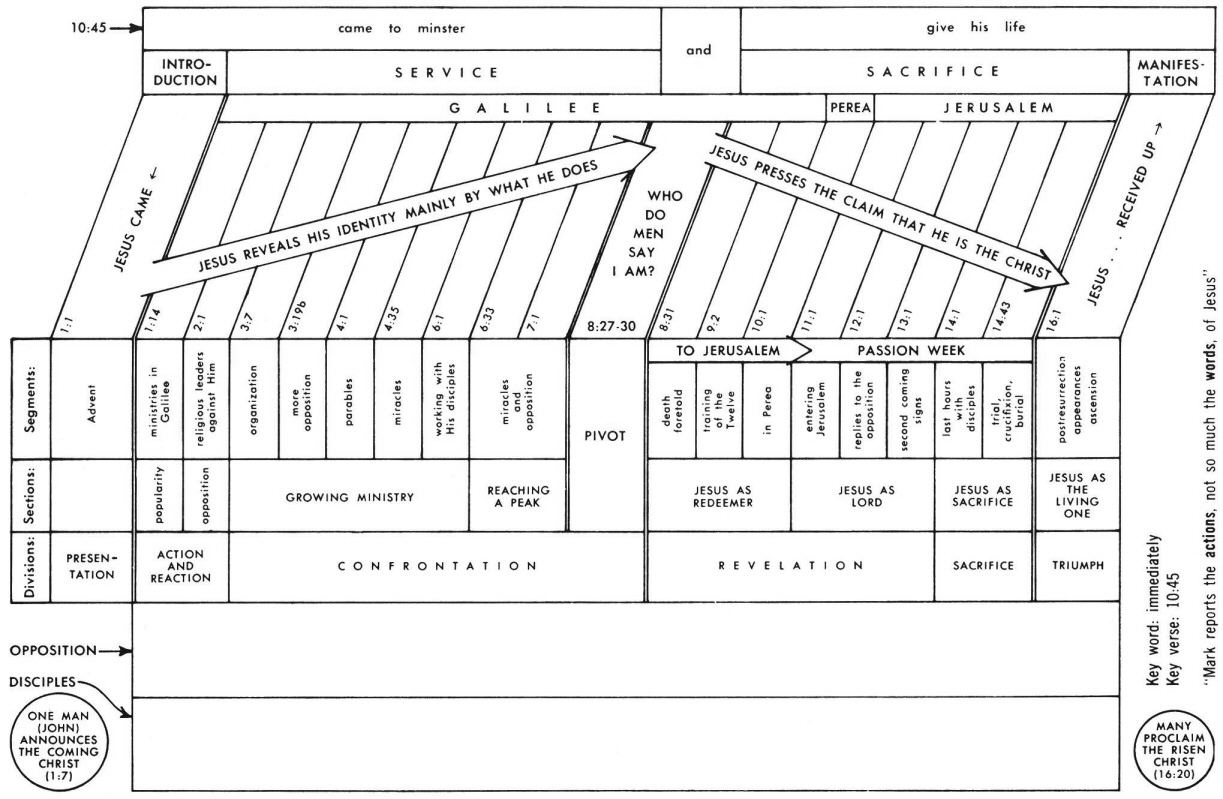

Mark 4 Commentary Precept Austin

Expense Budget Templates 15 Free Ms Xlsx Pdf Docs Budget Template Budgeting Templates

27 Companies Who Hire Adults With Autism Workology

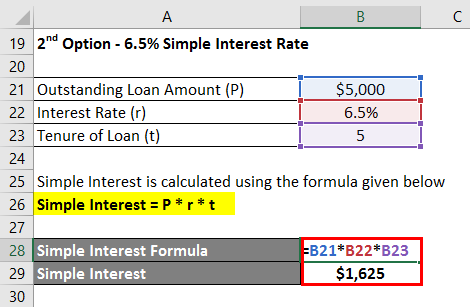

Interest Formula Calculator Examples With Excel Template

The Third Variable By Barry C Knapp

27 Credit Repair Tips And Resources Boost Your Credit Score In 2022